Pay BBMP Property Tax Online: Step-by-Step Guide

If you own a property in Bengaluru, you are required to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. Property tax is a major source of revenue for the BBMP, which is responsible for providing civic amenities and infrastructure in the city. Paying BBMP property tax on time can help you avoid penalties and legal issues, as well as contribute to the development of your locality.

Paying BBMP property tax online is a convenient and hassle-free option for property owners. You can pay your property tax online using the BBMP Property Tax System, which is a web portal that allows you to calculate, file, and pay your property tax online. You can also check your payment status, download receipts, file grievances, and update your mobile number on the portal.

In this article, we will guide you through the steps to pay your BBMP property tax online for the year 2023-24. We will also explain the benefits of paying property tax online, the documents required, the modes of payment, and the deadlines for paying property tax.

By the end of this article, you will be able to pay your BBMP property tax online with ease and confidence.

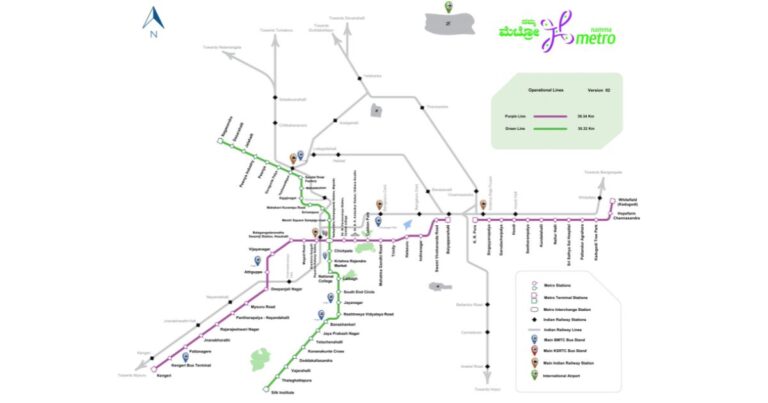

Consider reading: Bangalore Metro Timings and Station List

BBMP Property Tax Calculation, Deadline and Discounts

Factors Influencing BBMP Property Tax Calculation

- Property Location: The tax varies based on the area where your property is situated.

- Property Size: Larger properties may attract higher taxes.

- Property Type: Different rates apply for residential, commercial, and industrial properties.

Payment Deadlines

- First Installment: Due by 31st March annually.

- Second Installment: Due by 30th September annually.

Tax Exemptions and Discounts

- Senior Citizens (60+ years): Enjoy a 50% discount on property tax.

- Persons with Disabilities: Eligible for a full (100%) exemption from property tax.

- Consistent Payers: A 5% discount for those who’ve paid their property tax promptly for the past three years.

BBMP Property Tax Payment Methods

Paying your BBMP (Bruhat Bengaluru Mahanagara Palike) property tax is now more accessible than ever, thanks to multiple payment methods. This guide covers the various ways you can settle your tax dues efficiently:

1. Online Payment: A User-Friendly Approach

- BBMP’s Online Portal: The most convenient method. Access the portal, enter your property tax account number, and the due amount.

- BBMP Mobile App: Pay on-the-go using the official BBMP app, designed for user-friendly tax payments.

2. Offline Payment: Traditional Yet Effective

- Designated Bank Branches: Visit any bank branch authorized by BBMP. Carry your property tax account number and the payable amount.

- BBMP-Approved Payment Centers: Make payments at certified centers. Ensure you have your account details and the tax amount with you.

3. Payment Aggregators: Modern and Versatile

- Platforms like Paytm and Google Pay: These popular aggregators offer an easy way to pay your property tax. Simply input your property tax account number and the amount due.

After completing the payment, you’ll receive a receipt. It’s important to keep this receipt for record-keeping and future reference.

Consider reading: Top 10 Best Colleges in Bangalore – IIMB, SIBM, NLSIU, IBA, XIME and Others

How to Pay BBMP Property Tax Offline

Paying your BBMP (Bruhat Bengaluru Mahanagara Palike) property tax offline is a straightforward process. Here’s a detailed guide to assist you:

Where to Pay Your BBMP Property Tax Offline

- BBMP Head Office: Access comprehensive services and guidance on property tax payment.

- BBMP Ward Offices: Conveniently located for easy access to residents of specific wards.

- BBMP Collection Centers: Dedicated centers for quick and efficient tax payment.

- Partner Banks: Pay your tax at participating banks for added convenience.

- Post Offices: Utilize local post offices for a hassle-free payment experience.

Essential Documents for Offline Payment

Before heading to any of these locations, ensure you carry the following:

- Property Tax Bill: The most recent statement for your property tax.

- Aadhaar Card: For identity verification.

- Bank Account Details: Necessary for payment processing and receipt generation.

Offline Payment Process

- Visit a Payment Location: Choose from the BBMP Head Office, Ward Office, Collection Center, Bank, or Post Office.

- Submit Required Documents: Present your property tax bill, Aadhaar card, and bank details to the cashier.

- Make the Payment: Pay the due amount via cash, check, or card, as available.

- Obtain Receipt: Secure a receipt as proof of payment, crucial for future reference.

Alternative Online Payment Option

In addition to the offline methods, BBMP offers an online payment facility. This convenient option allows you to pay your property tax from the comfort of your home. For more details and to use this service, please visit the official BBMP website.

Consider reading: Best Places to Visit in Bangalore

BBMP Property Tax Payment Due Dates

The due dates for BBMP property tax payments are as follows:

- The first installment is due on 31st March

- The second installment is due on 30th June

- The third installment is due on 31st September

- The fourth installment is due on 31st December

If you miss any of the due dates, you will be charged a late payment fee. The late payment fee is 1% of the total amount of tax due for each month that the payment is late.

BBMP Property Tax Late Payment Charges

If you pay your BBMP property tax after the due date, you will be charged a late payment charge. The late payment charge is 1% of the total amount of tax due, per month. For example, if your property tax bill is Rs. 10,000 and you pay it 1 month late, you will be charged a late payment charge of Rs. 100.

The late payment charge is capped at 10% of the total amount of tax due. This means that you will not be charged more than Rs. 1,000 in late payment charges, regardless of how late you pay your bill.

If you are unable to pay your property tax on time, you can apply for a waiver of the late payment charges. To apply for a waiver, you must submit a written request to the BBMP along with proof of your financial hardship. The BBMP will review your request and decide whether or not to grant a waiver.

Consider reading: Best Restaurants in Bangalore

BBMP Property Tax Exemptions

The following are some of the exemptions that may be available for BBMP property tax:

- Senior citizens (aged 60 years and above) are eligible for a 50% exemption on their property tax.

- Disabled persons (with a disability certificate issued by the government) are eligible for a 100% exemption on their property tax.

- Property owners who are economically weaker sections (EWS) are eligible for a 100% exemption on their property tax.

- Property owners who are widows are eligible for a 50% exemption on their property tax.

- Property owners who are serving in the armed forces are eligible for a 50% exemption on their property tax.

For more information on BBMP property tax exemptions, please visit the BBMP website or contact the BBMP tax office.

How to Check BBMP Property Tax Arrears

Managing your BBMP (Bruhat Bengaluru Mahanagara Palike) property tax arrears is now more straightforward, whether online or in person. This guide will walk you through the process to ensure you stay updated with your tax obligations.

Online Check for BBMP Property Tax Arrears

- Locate Your Property Tax Number: This is found on your property tax bill.

- Remember the Assessment Date: Note the date of assessment mentioned on your bill.

- Access BBMP Website: Visit the BBMP official website.

- Navigate to ‘Property Tax’: Find and click on the ‘Property Tax’ tab.

- Select ‘Check Arrears’: Click on the link to proceed.

- Enter Details: Input your property tax number and the date of assessment.

- Submit and View Arrears: Click ‘Submit’ to view your property tax arrears.

Checking Arrears at the BBMP Office

- Carry Your Tax Bill: Bring along your original property tax bill for reference.

- Visit BBMP Office: A visit to the local BBMP office can provide personalized assistance.

Need Help?

For any queries regarding your property tax arrears, feel free to contact the BBMP office for support and guidance.

How to Appeal BBMP Property Tax Assessment

f you disagree with your BBMP (Bruhat Bengaluru Mahanagara Palike) property tax assessment, you have the option to appeal. It’s important to act promptly and follow the correct procedure. Here’s a guide to help you navigate the appeal process effectively:

Steps to File Your Appeal

- Submit Within 30 Days: Ensure your appeal is written and submitted within 30 days from the assessment date.

- Include Essential Information:

- Your Name and Address: Clearly state your full name and residential address.

- Property Address: Mention the address of the property in question.

- Assessment Date: Note the date when the property was assessed.

- Assessment Amount: Indicate the amount stated in the assessment.

- Reasons for Appeal: Articulate your grounds for appealing the assessment.

BBMP’s Review Process

- Decision Timeline: The BBMP commits to reviewing your appeal and making a decision within 60 days of receiving your appeal.

- Outcome: If your appeal is accepted, the BBMP will adjust, reduce, or eliminate your property tax assessment as deemed appropriate.

Need Assistance?

For more guidance on the appeal process or any other property tax-related queries, please contact the BBMP office or visit their official website.

FAQs on BBMP Property Tax

How can I pay my BBMP property tax online?

Paying BBMP property tax online is straightforward. Visit the BBMP’s official website, select ‘Property Tax’ from the services menu, enter your Property Identification Number (PID), and follow the prompts to complete payment. Ensure your transaction is successful by saving the e-receipt for future reference. This method is secure and convenient for all property owners.

What is the last date for BBMP property tax for 2023 24?

The deadline to file BBMP property tax for the fiscal year 2023-24 is March 31, 2024. Property owners are encouraged to pay by this date to avoid any late fees and ensure compliance with tax regulations.

How can I check my pending property tax in Bangalore?

You can check your pending BBMP property tax in Bangalore by visiting the Bruhat Bengaluru Mahanagara Palike’s official website. Navigate to the Property Tax section, enter your Property Identification Number (PID), and click on the ‘submit’ button to view your pending tax amount. Make sure you have your property details handy for a successful search.